Investing in Real Estate

Investing in real estate was the prime option for ofer 95% of the golden visa application and will continue to be the preferred choice due to the high market attractivity and profitability.

According to INE5, during the 2nd quarter of 2020 (last 3 months), the median price of housing units in Portugal was 1 187 euros/m2, with only 3 of the 25 NUTS III sub-regions (Note: NUTS II: made up of 25 units, the sub-regions, of which 23 are on the mainland and 2 in the Autonomous Regions of the Azores and Madeira, and correspond to the inter municipal entities) recording a median price of housing units above the national value: Algarve (1 807 euros/m2), Lisbon Metropolitan Area (1 601 euros/m2) and the Autonomous Region of Madeira (1 310 euros/m2).

Considering the current figures per square metre, an extended investment period could be a determining factor in negotiations and adjustments to the entry prices of investments. Moreover, this lag will allow a more effective framework for investment in the current context and the variation in market values. The prices are slowing down, e.g. Lisbon “only” rose by 1.3% during the second quarter, with a median value of 3,376 euros per square metre. Certainly, below the 2.6% rate recorded at the beginning of the year, but we consider that Portugal continues to deserve the confidence of the markets.

To respond to the demand of the national market, new construction in peripheral areas are undertaken, but high construction costs and time-consuming licensing processes continue to complicate their development. Concerning the strategy adopted in the premium areas, namely the focus on high rents assumed by tenants of considerable financial magnitude, and although there is evidence of relative overvaluation of rental values in most municipalities in metropolitan areas, Lisbon is one of the exceptions. The capital is more dynamic in both markets: for every 100 standard dwellings 4 have been traded and 1.6 new rental contracts have been signed.

Finally, the Covid-19 period will mark the residential market and the way we traditionally see it. In Portugal, the effects of Covid-19 may generate new buying habits, new living needs and lifestyles that break with a more traditional vision of this market.

The millennials generation and the future generations that will enter the labour market in the next years also defend different values from the previous generations, which will be reflected in the emergence of new housing models. Generations that firmly value the mobility factor, forcing more than ever the residential sector to reinvent itself and follow this trend. The increase in single-parent households, the rise in sales prices, and the degree of uncertainty about the future have also led to greater demand from the rental market which is unparalleled in the supply market.

As a result of the closure of a high percentage of local housing, the housing supply market could see an increase in the supply available in the coming months, particularly in urban centres. On the selling market, as we previously mentioned prices are beginning to slow down but a significant and continued fall in market values is not expected by experts, based on the resilience of this segment, which should almost fully recover after the end of the pandemic crisis.

From our point of view there are strong reasons why real estate is a very good option to obtain the Golden Visa:

- Profitability: Real estate can grant a annual capital growth rate of around 7% (see our business case simulation below) . Touristic renting can even have higher rates. Funds do not guaranty a return rate or if they do the maximum is 1,5%. You do not pay taxes currently but you pay high management fees or or custodian fees.

- Stability: Even during a financial crisis the rents will maintain while other options like funds will likely lose capital. Real estate also gains value with time and does not depend on risk capital manager. Funds investor should expect to realize all gains only after 5-10 years.

- Safety: If you have to come to Portugal because you have to leave your home country you have a home that you can use for yourself. If your children want to live in Europe to study they already have a place to stay.

- Growth: Although the prices in Lisbon have increased in the last years, Portugal is still among the cheapest real estate markets in Europe with strong growth rate of about 15% per year. Even in more rural areas real estate has grown more than 5% per year making investment profitable.

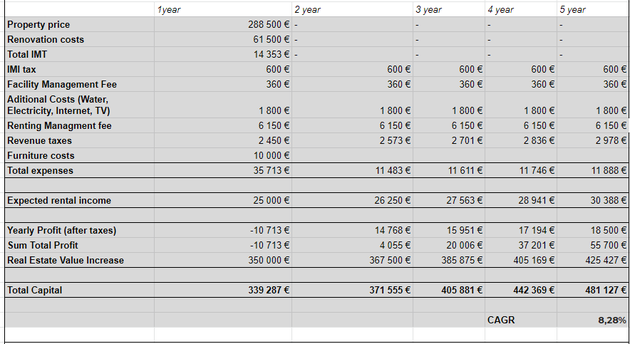

Business case simulation real estate investment

We simulated a business case for a 350k (288,500 EUR property and 61,500 EUR renovations) real estate investment for a short term (touristic) renting objective. The business was made under the following conservative assumptions:

- The purchase tax IMT is 8% of the property value minus a standard discount of 11035.25 EUR leading to an end value of 12,044 EUR. So the actual tax rate is 3,9% of the real estate costs. There is a 0,8% processing fee which comes on top of the tax (2,308 EUR).

- The yearly tax rate IMI is between 0,3% and 0,45% of the property matrix value which is essentially much more lower than the market value of the real estate. We calculated with 600 EUR.

- The facility management costs (condomínio) are around 30 EUR per month for apartments. Houses do not have to this kind of cost.

- The furniture costs for an apartment with 2-3 bedrooms, 2 bathrooms, one new kitchen and a living room are around 10.000 EUR

- The costs for electricity, water, TV and internet are max 150 EUR per month

- Management companies for short term renting earn around 20% plus VAT (23%) of the turnover you earn with the real estate.

- In touristic renting you pay a tax of 28% over only 35% of your turnover. This result in an overall taxe rate of 9.8% of your turnover.

- The rents can usually be increased by at least 5% for a well managed property.

- A good positioned apartment for touristic renting earns around 35,000 EUR per year. We calculated with 25,000 per year over the entire time period. Usually the longer the real estate is on the rental market the better is the turnover.

- Currently the value increase of real estate in Portugal is approximately 13% (idealista.de). We calculated with a 5% rate which corresponds to the weakest rural areas in Portugal.

Even with this conservative case the annual capital growth rate is 8,28% after taxes. Of course the success of an investment depends on the purchase of very good real estate. We from Pearls of Portugal are specialized to find this kind of properties for our clients. If you would like to have a simulation for personal investment strategy please contact us.

The business case is an simulation based on market experience and market figures. Actual investments can vary in their results

What are the real estate investment options?

The most popular investment option for the Golden Visa in Portugal is a purchase of real estate. There are 4 types of investment options. The invest of 500,000 EUR in any type of real estate and in any part of Portugal is the original and least complicated option. The amount is reduced to 400,000 EUR (20% discount) if the real estate is located in a low density area.

The third option is to invest 350,000 EUR in renovating a property that is over 30 years of age or located in designated urban renewal areas. The 350k is therefore the sum of the real estate and renovation costs. The fourth option is again a 20% cheaper investment of 280.000 EUR if the real estate is located in a low density area. The pros and cons of the investment options are described below.

1. The 500k option

Requirements: You have to invest a total 500 TSD EUR in Portugal regardless where and how many properties you buy.

Recommended real estate types: There are four recommended options in the 500k range. If you are interested in an optimal return of investment you should buy 2 apartments in the center of Porto or Lisbon for touristic renting or buy 3-4 apartments in Porto or Lisbon for longterm renting. If you would like to have a good return of investment and maybe would like to move to Portugal in the future you should buy a larger apartment in the center of Porto and Lisbon for touristic renting or buy a bigger house at the silver coast or the Algrave and rent it to tourists. You can also buy land (only) in the 500k option.

Evaluation: The 500k option is the safest in terms of the Golden Visa approval and also the option with the best return of investment perspective. Reselling in the cities is much easier and the markets grow better than other areas. Because of the high growth rates and the restrictions for touristic renting in Lisbon, Porto is currently the better choice to invest. Touristic properties can always be rented with good returns to the long term market.

2. The 350k option

Requirements: You have to buy real estate in Portugal that has more than 30 years and that needs to be renovated. The renovation costs will be considered when applying for the Golden Visa program. So the 350 TSD EUR will be the sum of the real estate costs and the renovation costs. Instead of the 30 years can can buy a property that is located in a regeneration area. Due to the more complicated definition the house age is a far more recommendable option. The renovation have to be at least 20% of the cost of the property. So if the house costs 300 TSD EUR the renovations have to costs at least 60 TSD EUR.

Recommended real estate types: There are two recommended types of properties for this option. Either you buy one apartment to renovate in the center of Porto or Lisbon and rent it to tourists or you buy a smaller house to renovate in the two cities to renovate it and turn it into 2-3 apartments and rent them to tourist. You can also do long term renting with them in the local market.

Evaluation: The returns of renting will be good but not as high as in the 500k option with several properties because you have to invest more in one or max 2 properties to renovate. The option is still reasonable because you can buy a good real estate in the best areas in Portugal and usually the real estate should gain significantly value through the renovations. Such projects need to be approved by SEF as qualifying for the reduced investment amount and it is critical to ensure the right project and legal advice is obtained before embarking on such investment

3. The 280k option

Requirements: You have to buy real estate in Portugal that has more than 30 years and that needs to be renovated. The renovation costs will be considered when applying for the Golden Visa program. So the 280 TSD EUR will be the sum of the property costs and the renovation costs. Instead of the 30 years can can buy a property that is located in a regeneration area. Due to the more complicated definition the house age is a far more recommendable option. The property has also to be located in a low-density are in Portugal.

Recommended real estate types: There are two recommended types of properties for this option. There a good vacation properties in the national parks especially in Gerês. So you buy a vacation property, renovate it and rent it to tourists with good to moderate income perspectives. The second option is to buy agricultural real estate with a house to renovate. This options is valid for land that have wine, olives or especial nuts like almonds or cork.

Evaluation: The cheapest option is reasonable with moderate return of investments. The low-density areas make reselling more complicated. The application process is also more complex. Such projects need to be approved by SEF as qualifying for the reduced investment amount and it is critical to ensure the right project and legal advice is obtained before embarking on such investment

4. The 400k option

Requirements: You have to invest 400 TSD EUR in one or more properties in a low density-area in Portugal.

Recommended real estate types: The best real estate for this option are bigger agricultural land with housings or touristic complexes like camping parks or small hotels.

Evaluation: This option is the least recommended option unless you are specifically interested in farming or larger touristic activities in the interior of Portugal. However the application is much easier than in the option 280k or 350k.

How can I make profit with real estate in Portugal?

Real estate is an optimal choice to make profit during the your Golden Visa application. There are various solid ways to invest into the local real estate market. We summarized the main five of them. Investing into apartments and renting them to tourists is currently the most popular alternative among investors. However, if the Golden Visa investment is broken up into several properties you can also make a very good investment in the local renting market.

Touristic Rental / Short term renting (Alojamento Local)

The tourism sector is one of the most strongly affected by the pandemic. Social isolation, flight suspensions, and cancelled bookings generate historic falls in the hotel segment across Europe.

A significant drop in hotel transaction volume is expected. The figures show that companies linked to the tourism sector should see a massive drop in their turnover compared to the year 2019. For now, the internal market is essential to ensure activity until the end of the year 2020.

Local Accommodation is one of the most affected tourist segments, where predicted falls could reach 90%. In April, local accommodation establishments recorded an average occupancy rate of 18% and 17% respectively. For the owners or operators of local accommodation units, it is time to embrace alternative strategies. In the coming months, local housing owners have the possibility to migrate to medium-term contracts that can last 12 months.

In what regards the hotels, despite the consequences of Covid-19, interest in the Portuguese hotel investment market seems to remain resilient, with quite attractive market fundamentals.

Since 2018, Portugal has been the scene of major transactions in the hotel segment, with important investors arriving from the United States, China, or Korea. Notwithstanding the uncertain times, interest in expanding their hotel chains to Portugal remains due to the recognition of Portugal as a safe tourist destination and an increasing professionalization and diversification of the offer. Our opinion is that even though the hotel business will struggle (a lot) until the end of the pandemic, mid and long-term prospects look more optimistic.

In contrast to other European countries, tourism and the renting of real estate enjoys a positive reputation in Portugal. Accordingly this is also promoted by the municipalities. As a private person you can very easily register a small business for rental purposes and apply for the new licences. This usually takes about 2 days.

From an Golden Visa investing point of view, apartments in the two major cities of Porto and Lisbon are the best options, but also real estate in the classic holiday regions such as the Algarve or Alentejo are particularly suitable alternatives. For apartments in the cities there are clear requirements for successful letting. Appropriate apartments must be centrally located with access to the subway. In addition, it must be a historic and renovated building in very good condition.

Established apartments generate an average of 25-35 TSD EUR per year. The management of theses apartment is taken over by professional administrators which manage of all important tasks of the rental. These are remunerated with 20-30% of your turnover. After taxes the landlord remains with about 65% of their turnover as profit. Corresponding properties are around 250.000 EUR as a minimum investment.

Renting of commercial real estate

Commercial real estate had a rather weak development in the recent years. The purchase costs for good locations are therefore around 1000 EUR per square meter. Nevertheless the market is interesting as the conversion of commercial space to official living space has become much easier due to the lack of housing. This will soon lead to a sharp increase in conversions and thus in a higher demand for commercial places.

In addition, commercial real estate such as a shops is interesting because you can already acquire the appropriate real estate with fairly low budgets. Smaller stores cost around 35.000 EUR in the big cities. The gross return for related properties is around 10%, which is a solid return compared to more expensive Golden Visa investment opportunities. In addition, the commercial space can be rented in the long term and has no high renovation costs.

Probably one of the most affected by the measures imposed by the lockdown, local retailers are suffering in sales volume, leaving their economic difficulties more exposed. It is premature to make an accurate estimate yet since the immediate activity continuity is still very uncertain within Europe and a global full reopening date cannot be forecasted.

The current restrictions imposed are expected to continue exercising a weight on sales volumes. We may see an increasing rate of availability of street shops which will lead to great pressure on rent values, as a result of activity closures and insolvencies. The acceleration of e-commerce will also affect traditional shopping habits impacting physical shops' preeminence.

Long term renting

Similar to other European countries there is a very strong lack of housing in urban areas in Portugal. The rate of privatley owned properties used to be 95%. In recent years, the market has developed into a strong rental market. Particularly in demand are smaller apartments in classic residential buildings which are not located in the center but in connection with the inner cities.

The entry price for 2-3 bedroom apartments is around 150 TSD EUR and is therefore much more affordable than in other major European cities. The rents are usually at 8-11 euros per square meter. With the Golden Visa investment of 350 TSD EUR you can achieve a gross rent of approx. 2000 EUR per month.

Hotel in Portugal

Portugal is a classic holiday destination with a strong increase in demand from foreign tourists. The market for hotels and the supply of hotel real estate is correspondingly well developed. Objects with 10-20 beds can already be purchased with 400.000 EUR. Smaller objects can also be purchased much cheaper. Many investors focus less on a traditional main building but on the construction of mobile units through which the capacity can be successively expanded.

In addition to the efficient management of the hotel and the location the underlying concept behind capital investment is most decisive. There are a lot of classic hotels in Portugal. In order to prevail on the market, it is therefore necessary to occupy a niche or a strong feature in the market. This concept should already be considered when searching for the right property. For smaller budgets the construction of a hostel in the big cities or a pilgrim hostel in the north of Portugal is suitable.

Agricultural land with houses

Portugal has a long tradition in agriculture and is well known for its wine and olive oil production. There exist also many smaller markets with higher margins like cork trees or nuts like almonds that have stable markets. General fruits like oranges or all kind of vegetables are not recommendable because of the strong competition in Europe especially from Spain.

Farm land in Portugal is usually less expensive because the plots are located more in the interior parts of Portugal. This makes also the acquisition of houses much more cheaper as they are required for the Golden Visa approval.

What are the total costs for the real estate application?

Most applicants for the Golden Visa would like to have an overview of the total costs involved. Therefor we simulated the costs for the most popular options for a family of four for the real estate Golden Visa application. The cost overview covers the acquisition costs and the applications cost.

500k Golden Visa Portugal cost overview

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Source: Martinez Echevarria

350k Golden Visa Portugal cost overview

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Source: Martinez Echevarria

Despite the great care, we take over no responsibility for the topicality, correctness, completeness of the information on this site.